Introduction

Many developing countries in recent times have echoed on the words “Chinese bondage — usury loan borrowing gone wrong”. Relying on huge loans, China has spread its tentacles across the globe as it marches towards becoming a global economic giant. Although these loans can provide a financial lifeline, they tend to carry exorbitant interest rates and hidden loan terms that many say are akin to economic slavery.

The Allure of Chinese Loans

We can see this played out on the global level, as in China’s Belt and Road Initiative (BRI). Chinese loans are often welcome by countries looking to build infrastructure quickly. I mean, who would not want a shiny new highway or prancing and gamboling airport or railway? Unfortunately, the old saying goes that if something seems too good to be true then it likely is.

The Trap of Usury

Chinese loans are infused with so much usury, the practice of lending money at exorbitant interest rates. What looks to be a competitive offers on the front end are where borrowers would get caught based upon the hidden costs. So, countries get stuck in medium to long-term repayment schedules with progressively increasing interest rates that strangle them into a deadly vortex of debt.

Hidden Debt Risks

One of the biggest problems with these loans is their lack of transparency. Often, the terms and conditions are cloaked in confidentiality which leaves an opacity for borrowing nations about what exactly is agreed on. Governments routinely learn years later that they contend with billions more outstanding than originally recognized. The result? A country, strangled in debt and losing its sovereignty.

Consequences of Borrowing Gone Wrong

It has devastating consequences borrowing from China. A number of countries are now unable to meet their repayment commitments. This has in turn led them to compromise, eg of renting out precious land or assets and/or to allow China hands on the country’s essential infrastructure.

Sovereignty for Sale

The most troubling results is the relinquishment of national independence. After unable to repay their loans, countries like Sri Lanka had no other choice but lease its Hambantota Port for 99 years with a Chinese company. That has sparked fears that other countries could meet the same fate and become little more than economic vassals under China.

Social and Economic Impact

These loans also have social implications. Countries in debt to China often must slash public services, breeding unrest. The resources the heavily indebted nations will need to divert from economic growth into repaying their debt, as instead of developing they slide further (or remain) in poverty.

Real-Life Stories: Usury Loan Borrowing Gone Wrong

Case Study #1: The Businessman’s Downfall

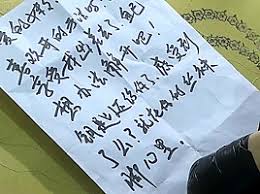

What about Mr. Li, a Beijing small business owner. In other words…when faced with daunting odds to keep his business from going under, he took out a usury loan. Looked like the perfect answer to start with! The loan got approved within a few days, and the money was transferred to his account. However, over the next few months is where things began to escalate.

Try as he might, Mr. Li couldn’t manage to make the payments regularly. When he failed a second time, it was too much—so the loan shark threatened to take him into court and when that didn’t work they stormed his gate. Fearing for his safety and the safety of his family, Mr. Li was forced to sell at a loss leaving him bankrupt financially ruined and looking weighed down emotionally

Case Study #2: The Student’s Nightmare

Also Xiao Mei, a university student struggling with sky-high usury loan for tuition fees. Left unable to get a conventional loan, she sought capital from private lenders who offered cash at high interest rates and quick turnaround with “no questions asked.” Then to be a hangman’s knot on her throat.

The loan she had taken was running on such high interest that instead of repaying the fund, she started getting default in paying even just interest. She started to be hounded day and night by the lender who even went so far as threaten that her debt would be posted on social media, which ultimately led him to contact both her family + university. The stress was too much and Xiao Mei eventually left school, her hopes for a life of anything better now shattered.

A Path Forward?

How then can countries escape from this vortex? First, transparency is key. Any country borrowing should be able to demand clarity of terms knowing what they are getting themselves into or the cost at least. Meanwhile, devisifying the sources of funding served to diversify risk across lenders as well.

📚 FAQs

- If it comes with charges why do countries still borrow from China?

Q: They see Chinese loans as a sexy alternative because it comes with cash up front and China willing to invest in these kind of big, huge infrastructures projects? But, most of the times they are disoriented about long term costs.

- Do you think that all the China loans are usurious?

A: Not all Chinese loans are predatory ones, but most have hidden terms that make the costs over time much more expensive. Borrowing countries must carefully examine the terms before agreeing.

- Are countries permitted to renegotiate the terms of their loans?

Q: There have been some instances where countries tried to renegotiate their loans, but China has not shown much appetite for debt forgiveness or term changes. The result is that countries are trapped in high debt.

Conclusion

The case of “Chinese bondage – How Chinese usury loan borrowing went deadly wrong?” sends a chilling caution to any country thinking about this. Quick infrastructure funding may be enticing, but the long-term effects can prove disastrous. Understanding the risks, demanding transparency and exploring alternative ways of borrowing can shield nations from usurious debt. Many have learned this the hard way, but you cannot overlook it.